Learning From Experience

Paul Anthony Thomas

My Vision

“The Older I Get, The More I Know I Don’t Know”

Principal

As a professional investor, Paul is a platform Generalist. He takes pride in knowing and understanding what he does not know. He surrounds himself with industry experts who have executed successful programs in the past and are ready to do the hard work necessary to be successful in the world of private asset management and investing.

Experience Leads Everything I Do:

Paul Anthony Thomas

- Member – Central Texas Angel Network

- Active Member – CFA Institute

- Board Member – Texas Alternative Investment Association

- Certified Professional Geologist

- Active Member of Society of Independent Professional Earth Scientists

- BS – Psy/Marketing, Texas A&M Univ.

- BS – Geology, Hardin Simmons Univ.

Career Highlights

- 54+ years finance, real estate, oil & gas, marketing, venture capital, publishing and hands-on asset management experience.

- Worked for 25 years as a financial analyst and newsletter publisher for New Horizons for Investors analyzing and executing over 100,000 transactions and researching fundamental details on over 7000 companies and private platforms covering equities, commodities, fixed income and private equity transactions.

- Drilled and completed over 500 oil and gas wells as well-site superintendent, geologist/partner

- Leased for exploration over 2,000,000 acres of land in North America

- Has owned an equity interest in 180+ commercial/residential properties, developed and managed real estate assets since his first purchase in 1981. His family has been in the business of owning and managing multifamily, commercial and industrial real estate assets since the 1950’s. He currently has a team developing raw land for commercial and residential use in Texas.

- Consulted for then worked for the US EPA Region 6 Dallas office for over 7 years as an emergency responder, public relations officer, chemical cleanup specialist, regulatory specialist, industrial/hazardous waste expert and enforcement officer. Worked directly on the US/Mexico Team, Gulf of Mexico Team, Emergency Response Team and Industrial Waste Regulatory Team. Wrote Solid Waste portion of NAFTA. Helped write the E-50 Phase I Real Estate Guidelines for ASTM. Emergency Responder/Hydrogeologist/Air Modeler/Pipeline and Cleanup Specialist

- Mr. Thomas is a Certified Professional Geologist with over 15 years as a well site superintendent & exploration professional and an additional 15 years in upper management of petroleum production and exploration operations. Mr. Thomas currently manages field operations of producing leases in Texas and non-operated interests located in 5 states.

- Environmental Scientist

- Former Principal NASD Broker-Dealer (Series 22, 63, 6)

- Former Principal SEC Registered RIA (Series 65)

- Member CFA Institute

- Member AAPL

- Member AAPG

- Registered Landman

- Editor: The ABC’s of Coin Investing (1965),

- Editor/Publisher: New Horizons For Investors Newsletter (1967-1975),

- Editor: Human Psychology in the Stock Market (1969)

- Editor/Publisher: Supertrends Investment Newsletter (1975-1978),

- Author: Making Money In Commercial Real Estate (1999),

- Author: Winning with Private Equity (2005),

Get Our 2025

Platform Research

Private Hard Asset Portfolios Designed To Lower Your

Risk And Increase Your Return

How can portfolio return be increased with increasing portfolio risk?

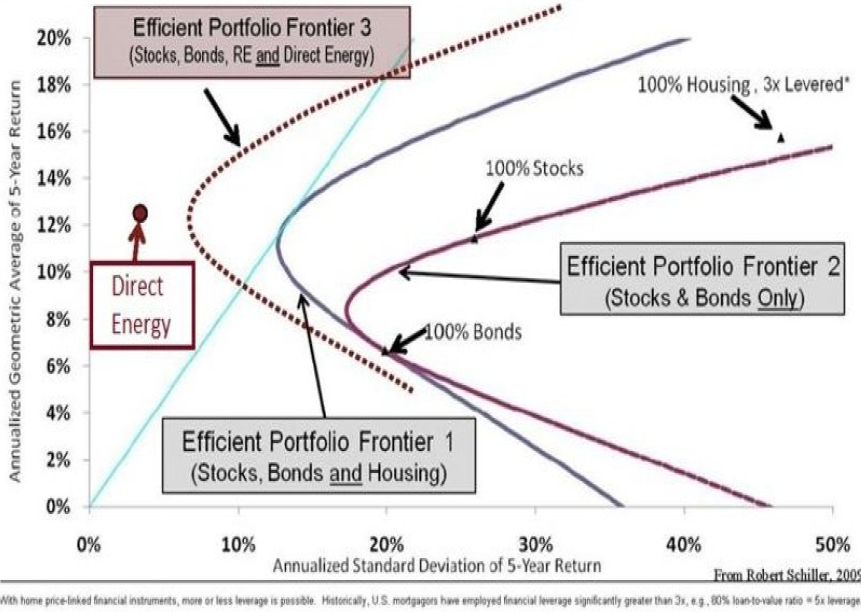

The answer is the use of Modern Portfolio Theory (MPT) in the design and implementation of the portfolios. MPT won the Nobel Prize for Harry Markowitz in 1952. The use of MPT maximizes portfolio return for a given level of risk by carefully choosing the proportions of various asset classes within the portfolio. MPT used the efficient frontier, shown above, which allows advisors to select optimum asset classes for their clients.

On the chart above, Efficient Portfolio Frontier 2 is comprised of Stocks and Bonds only. You can see the risk (Standard Deviation) is much higher for the expected return. Efficient Portfolio Frontier 1 includes real estate and provides investors a higher return with less risk. From this chart you can see that inclusion of Direct Energy in a portfolio made of traditional assets and real estate can move you to Efficient Portfolio Frontier 3 providing even higher returns to investors, with less risk.

Custom Private Equity is a management group that completes in-depth research into market needs. We create executable capital strategies and manage investment platforms to put our in-house research, knowledge, and 50+ years of experience to work for our partners.